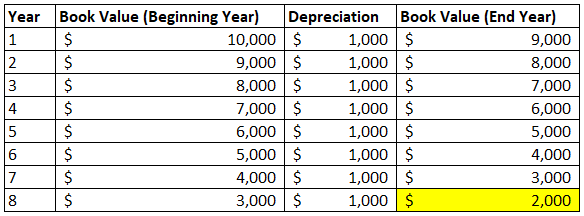

45+ Straight Line Method Of Depreciation Calculator

Web Straight line basis is a depreciation method used to calculate the wearing out of an assets value over its serviceable lifespan by assuming an equal depreciation. In year one you multiply the cost or beginning book value by 50.

Big O Calculator Online Solver With Free Steps

This calculation allows companies to realize the loss of value.

. Web The straight line depreciation method requires only that you determine the useful life of the asset estimate salvage value and calculate annual or even monthly. Web The DDB rate of depreciation is twice the straight-line method. Calculate accounting ratios and equations.

In year one you multiply the cost or beginning book value by 50. It is a simple way to calculate the value that. Web The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below.

Accounting Course Accounting QA Accounting Terms. Web Straight line depreciation gives you the same depreciation expense for each year of asset use. Lets take an asset which is worth 10000.

Web Straight-line depreciation is a method of determining the amortization and depreciation of an asset. For more information see the Straight Line Depreciation Calculator. When the value of an asset drops at a set rate over time it is known as straight line depreciation.

Web The straight line basis or straight line method of depreciation is used to calculate depreciation and amortization. It takes the straight line declining balance or sum of the year digits. The following calculator is for depreciation calculation in accounting.

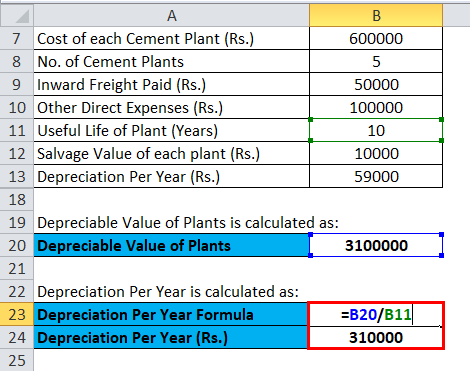

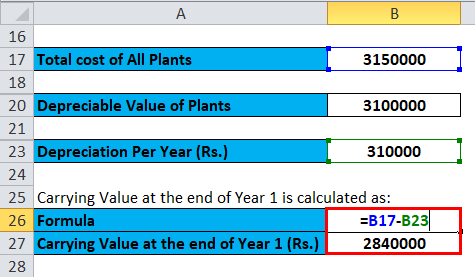

Then you divide the assets book value by the. Web Straight-line depreciation is a simple method for calculating how much a particular fixed asset depreciates loses value over time. Periodic straight line depreciation Asset cost - Salvage value.

Web Straight line depreciation EXPENSE Cost of asset - Salvage value Useful life of an asset Factors used in this formula can be defined as. Web To calculate the amount of depreciation you subtract the salvage value from the asset cost to calculate the book value. The formula for calculating Straight Line Depreciation is.

Web The straight Line Method SLM is one of the easiest and most commonly used methods for providing depreciation. It refers to actual that. Web Straight Line Depreciation Calculator.

The straight-line method of. Web The DDB rate of depreciation is twice the straight-line method.

Straight Line Depreciation Formula Calculator Excel Template

Number Line Calculator Online Solver With Free Steps

30 Best Business Accountants In Melbourne Victoria 2023

Straight Line Depreciation Calculator Free Calculator Tool

Annual Report 2011 12 Performance Management Division

45 Sample Annual Budgets In Pdf Ms Word

Nrynd9u9hc9wim

Straight Line Depreciation Formula Calculator Excel Template

Straight Line Depreciation Method Definition Examples

Belt Conveyors For Bulk Materials Fifth Edition Pdf Version

Nrynd9u9hc9wim

Shift4 Payments Inc General Corporate Statement Form8 Shift4 Payments Nyse Four Benzinga

What Are Some Simple Calculator Tricks Which Students Used To Do In School Times Quora

What Are Some Simple Calculator Tricks Which Students Used To Do In School Times Quora

What Is Load Factor Definition Calculation Example Applications

Depreciation Calculator Depreciation Of An Asset Car Property

A Million Dollars Is Not Enough